modified business tax refund

Nevada Tax Department Issues Excise Sales and Use Tax Notice Regarding Modified Business Tax Refund June 10 2021 500 AM The Nevada Supreme Court held the bill that. Click the tool in the top toolbar to edit your Modified Business Tax Return Nevada on the specified place like signing and adding text.

Income General Information Department Of Taxation

Email the amended return along with any additional documentation to nevadaolttaxstatenvus OR mail your amended return to.

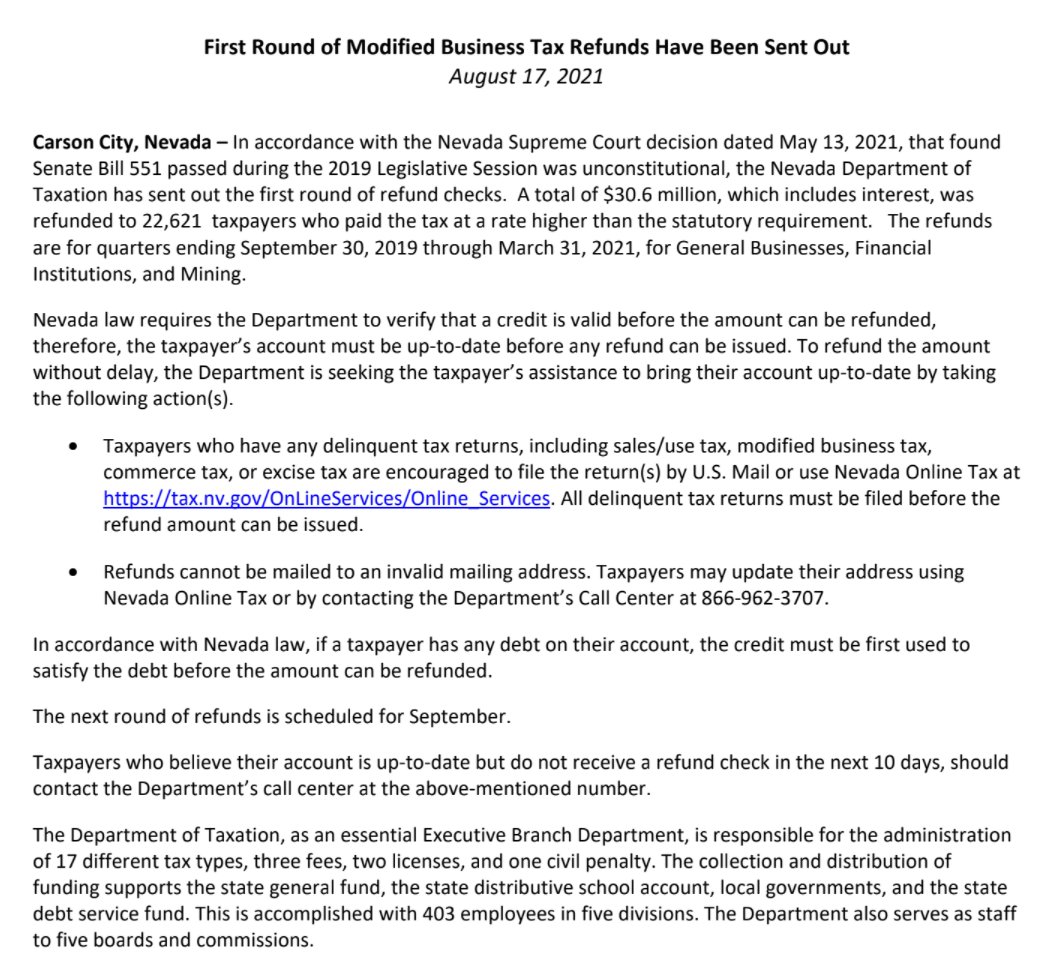

. MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection.

Nevadaolttaxstatenvus with the subject of Modified Business Tax Return Use this form for. In addition to the change to the Financial Institution definition and the. A new Modified Business Tax Return MBT-Mining has been developed for this reporting purpose.

The Nevada Department of Taxation has sent out the first round of refund checks to businesses that paid a tax recently struck down by the states Supreme Court as being. We will send a refund check unless the claimant is set up to receive refunds by direct deposit. According to the court a bill that was passed during.

On May 13 2021 the Nevada Supreme Court. Full Time and Part Time Employees Qualify. Modified Business Tax Return-Financial Institutions 7-1.

Employers to Receive Refunds of Overpaid Nevada Modified Business Tax The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1. The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from. Follow these steps to get your Modified Business Tax Return Nevada edited with.

The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. To email save this form to your computer and email the attachment to. You can base your estimated tax on the amount you paid the prior year even if you werent in business that year but your return for the year must have been for a full twelve.

Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as. If you need to file Sales Tax Use Tax or Modified Business Tax returns you can file these returns electronically after registering to use our interactive website NevadaTax. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada.

Taxpayers who have any delinquent tax returns including salesuse tax modified business tax commerce tax or excise tax are encouraged to file the return s by US. Department of Taxation 1550. Up to 26000 Per w-2 Employee.

Why Some Tax Refunds Are Falling Short Of Expectations For Families

1040 2021 Internal Revenue Service

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

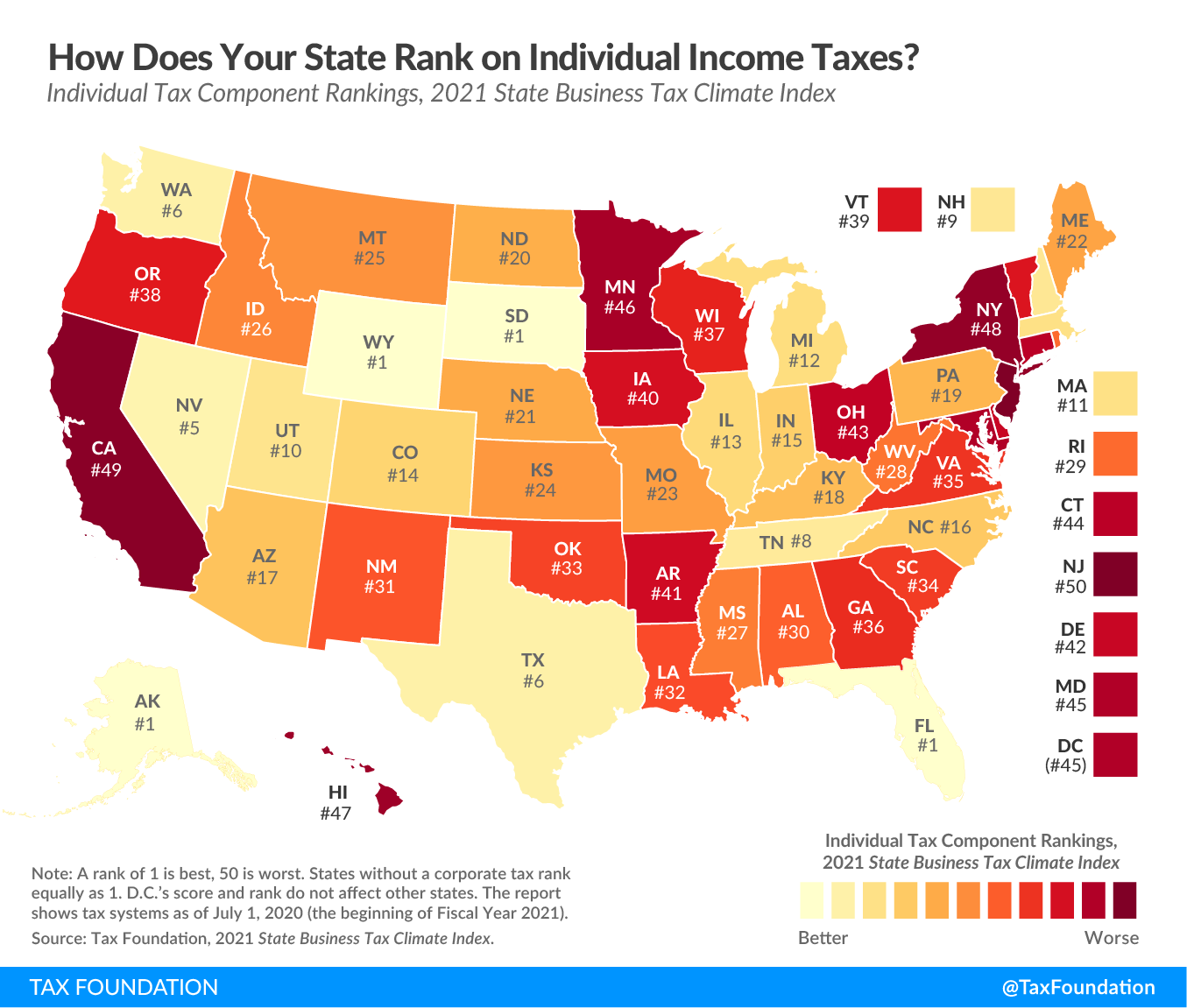

Best Worst State Income Tax Codes Tax Foundation

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Blayne Osborn Blayneosborn Twitter

Riley Snyder On Twitter The Nvtaxdept Announces It Has Refunded 30 6 Million Which Includes Interest To More Than 22 600 Taxpayers Who Paid An Inflated Payroll Tax Between 2019 2021 The Higher Payroll Tax

Common Irs Where S My Refund Questions And Errors 2022 Update

Tax Implications Of The Inflation Reduction Act Commerce Trust Company

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Holland Tax Business Services Home Facebook

(1).png)